iFood and Cade (Administrative Council for Economic Defense, which ensures free market competition) signed on February 8th a agreement on exclusivity contracts closed between the company and some of the platform's partner restaurants.

Exclusive contracts are those in which partner restaurants undertake not to make their delivery operations available in other countries. platforms and, in return, they receive investments from iFood and differentiated commercial conditions — a legal practice and in accordance with Brazilian competition legislation.

Through the signed agreement, the Where recognizes that the practice of exclusivity is legal, makes investments in restaurants viable and also generates efficiency for consumers. Furthermore, the body establishes legality criteria and limits for entering into exclusive contracts with restaurants.

“The changes foreseen in the agreement will bring more legal security to the sector as a whole and will imply changes to iFood's exclusive policy”, explains Arnaldo Bertolaccini, vice-president of restaurants at iFood.

Now, the company will have six months to implement the changes proposed by Cade — such as not signing exclusive contracts with brands that have more than 30 establishments and limiting the term of this type of contract to two years.

Below, check out the interview in which Arnaldo explains what changes with the new rules in the relationship between iFood and restaurants (exclusive or not).

iFN – What is the impact of the agreement signed with Cade on the iFood business?

Arnaldo – The agreement has relevant impacts on iFood's business, and we will still work to ensure that it is fully implemented within the deadline and conditions that were established.

Our first action will be to work with partner restaurants that will be impacted to ensure that they will continue to receive our best service, even without the exclusive contract.

Exclusivity agreements with some restaurants will be maintained, as long as they follow Cade's determination. Our main concern is to ensure that impacted restaurants can continue to receive full support so that the impact on their operations is minimized as far as possible.

There are cases where commercial terms and conditions will need to be renegotiated. In these cases, our commercial team will contact each affected establishment in the next few days to begin the process.

Partner restaurants without an exclusive contract will not suffer any changes to their contracts, commercial conditions or quality of service provision. Respecting the limits set out in the agreement with Cade —and if they are interested—, these restaurants will be able to enter into exclusive partnerships with iFood from now on.

iFN – How did this process happen with Cade?

Arnold – O iFood has been collaborating with Cade since the beginning of the investigation, which culminated in the signing of this agreement. It recognizes not only the dynamism of the food delivery sector, marked by the emergence of different business models, but also the importance and legality of the practice of exclusivity, as long as certain limits established in the agreement are respected. iFood's actions have always taken place within legal limits.

iFood's commercial policies are in compliance with competition legislation and we fully comply with the terms of the preventive measure imposed by Cade in March 2021. iFood has always respected and will continue to respect the agency's decisions.

iFN – What is an exclusivity contract between iFood and the restaurants like?

Arnold – As in any market, an exclusivity contract presupposes investments in a specific business in which you seek a return on the investment made and because you believe that it makes sense given your market strategy.

Exclusivity is nothing more than preserving this investment for a period of time to avoid what we call the free rider effect. This occurs when another competitor wants to enjoy the results without having made any contribution or effort.

iFN – Why continue with exclusive contracts, if they are so criticized?

Arnold – It is important to emphasize that exclusive contracts are not illegal. What we need are clear industry-wide rules. Restaurants told Cade that they prefer iFood because of service quality, the platform and the service we provide.

At the same time, iFood expands the market. Exclusive contracts serve to balance the investment we make to attract customers to the delivery sector, something that even benefits our competitors.

iFN – Competitors they claim that exclusivity contracts reserve the market and make the sector's competitiveness practically impossible. And truth?

Arnold – No. Competitive sectors directly benefit those most interested in the development of that market. In this case, the restaurant wins the most.

Cade sent a request to more than 30 restaurants asking about their relationship with the platforms and exclusivity contracts. The answers show that they do not feel dependent on contracts, that delivery is just part of their revenue, and that what makes them choose iFood is the quality of the platform and service provision, going against what Rappi has alleged.

iFN – According to Abrasel, iFood has a monopoly of 80% on the market. That is true?

Arnold – This data that Abrasel presents does not have a clear methodology and does not take into account all delivery methods. Brazil currently has numerous delivery platforms, especially outside major centers. Competitiveness is great, with companies such as Magazine Luiza, Americanas, Ambev and Grupo Pão de Açúcar investing in the sector.

Abrasel itself also says that half of restaurant orders are made through the establishments' own apps or WhatsApp. A survey by Sebrae shows that 74% of small businesses operate in e-commerce and that WhatsApp is the most used platform for sales, being adopted by 84% of them. Delivery apps are adopted by only 6% of establishments.

iFN – What are the limits defined by the agreement?

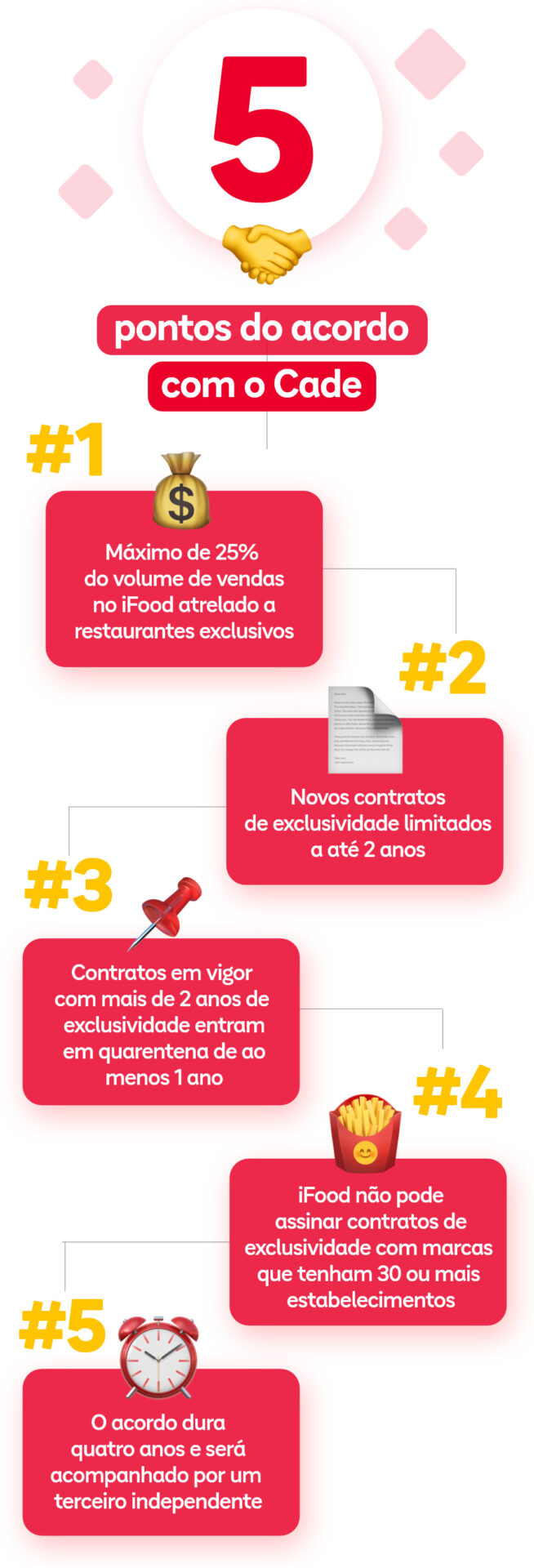

Arnold – The limits of the agreement with Cade are:

- A maximum of 25% of sales volume (GMV) on iFood may be linked to exclusive restaurants. In municipalities with over 500 thousand inhabitants, only 8% of the restaurants that work with the platform will be able to sign an exclusivity contract. iFood will have six months to adapt to these limits.

- New exclusivity contracts can be signed by iFood, but must be limited to a maximum period of two years. After this period, the restaurant in question must undergo a “quarantine” and remain without exclusivity with iFood for a minimum period of one year.

- As a general rule, exclusivity contracts that are currently in force and that have already accumulated two years of exclusivity fall into “quarantine” immediately after their current expiration date. There are exceptions to this rule depending on the investments made by iFood in the exclusivity contract and the growth generated for the exclusive partner, which will be dealt with individually by the iFood commercial team together with the impacted restaurants.

- iFood will not be able to sign exclusive contracts with brands that, at the time of signing or renewing the contract, have 30 or more establishments. Contracts currently in force with brands that fall under this prohibition must be terminated by 09/30/2023.

- The agreement lasts four years, and will be monitored by an independent third party chosen by iFood and approved by Cade, through semi-annual reports.

iFN – What will be iFood’s next steps from now on?

Arnold – We reiterate our commitment to developing the food delivery sector and increasing consumer well-being, we will work to adapt our business model to the new rules. Our goal is to offer the best platform for delivery people, consumers and restaurants.